All Tax News Provided by Google or Bing search engines: :

|

Back to Blog

CNC CASE CLOSED8/9/2017 Our Client in Oakland, CA has been submitted for a Currently Non Collectable status according to his financial situation and IRS guidelines in helping tax payer's like our Client help resolve tax nightmares. We are proud to serve our Nation Wide Client's through out their tax resolution and start the beginning of a "life time business relationship", we can file our Client's taxes for life and now start to offer book keeping services to those who need to be on track on their income verses expenses each month. This is key to have the best and most accurate tax preparation for the year at hand.

1 Comment

Read More

Back to Blog

CUANTO TIEMPO el IRS le puede collectar7/28/2017 Cuánto tiempo tiene el IRS para cobrar impuestos?

IRS puede tratar de obtener su declaración de impuestos hasta a 10 -20 años desde la fecha ellos fueron evaluados. Sin embargo, hay maneras de este período de tiempo pueden ser suspendido. Por ejemplo, por la ley, puede ser el tiempo para recoger suspendido mientras: • IRS considera su solicitud para un acuerdo de entrega o Oferta en compromiso. Si su solicitud es rechazada, suspenderá colección por otros 30 días y durante el período de los recursos Oficina está considerando su solicitud de apelación. • Usted vive fuera de los Estados Unidos continuamente por al menos 6 meses. Colección se suspende mientras estás fuera de Estados Unidos • Se incluyen los períodos impositivos que estamos recogiendo en una quiebra con una suspensión automática. Suspenderemos la colección del tiempo periodo que no podemos recoger debido a la suspensión automática, además de 6 meses. 4 Publicación 594 el proceso de recolección de IRS • Solicita una audiencia de debido proceso de colección. Colección será suspendidos en el .... lea mas en IRS.GOV

Back to Blog

By David Sherfinski, The Washington Times

The IRS doled out more than $24 billion in potentially bogus refunds claimed under several controversial tax credits in 2016, according to a new audit that said $118 million was even paid to people who weren’t authorized to work in the U.S. in the first place. Some $16.8 billion in payments were made on improper claims under the Earned Income Tax Credit, signifying a 24 percent error rate. Investigators also estimated $7.2 billion in improper payments for the Additional Child Tax Credit, representing 25 percent of the total, and $1.1 billion in improper payments, or 24 percent, for a higher education tax credit. READ MORE...

Back to Blog

BOARD OF EQUALIZATION7/21/2017 Extra! Extra! Read All About It: Lost Taxes De America tax professionals have done it again!! Our tax team has recently submitted an "offer in compromise" to lower a $44k debt to $15k with the most complicated tax agency in the world in conjunction with IRS guide lines (Board of Equalization) for our Client in California. After thorough financial analysis this is the best option for our Client to off set his tax liability in which he does not have the ability to pay. Great job! Los Taxes De America.

Back to Blog

CASO CERRADO7/21/2017 Nuestro Cliente de Huntington Park, Ca ahorro más de $14k, reduciendo su deuda de $15k a solo $886 dólares. Trabajó bien echo por nuestro equipo, Elena, Caridad, Ksenia y el dueño Mario. 👏👏👏👏👏👏👏👏👏 - #ClientePorVida

Back to Blog

lien removal:7/20/2017 We recently negotiated terms with California's Franchise Tax Board for our client in Stockton, Ca. We filed missing returns, after thorough financial analysis we negotiated an affordable monthly payment plan our client can afford and removed a much unwanted lien from our client's credit history. Now our client has peace of mind and can finally see the light at the end of the tunnel. Great job again! Los Taxes De America Team.

Back to Blog

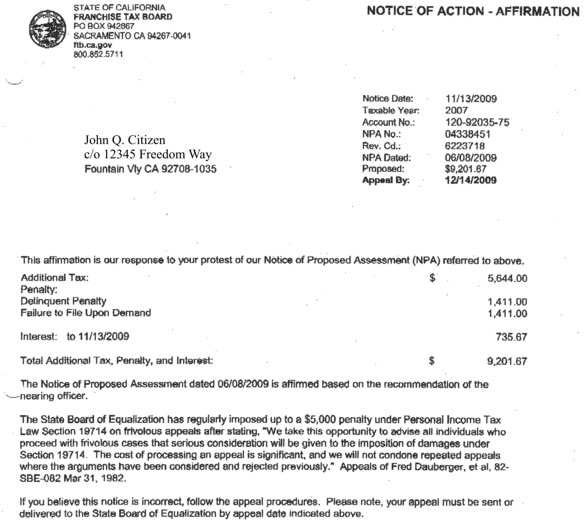

franchise tax board: we can help!7/20/2017 (picture is not a real notice) The Franchise Tax Board is another tax agency that can result in a tax nightmare. We recently filed all missing tax returns for one of our clients and brought his matter to a close with the Franchise Tax Board of California, resulting in a zero balance. Great job Los Taxes De America Team.

Back to Blog

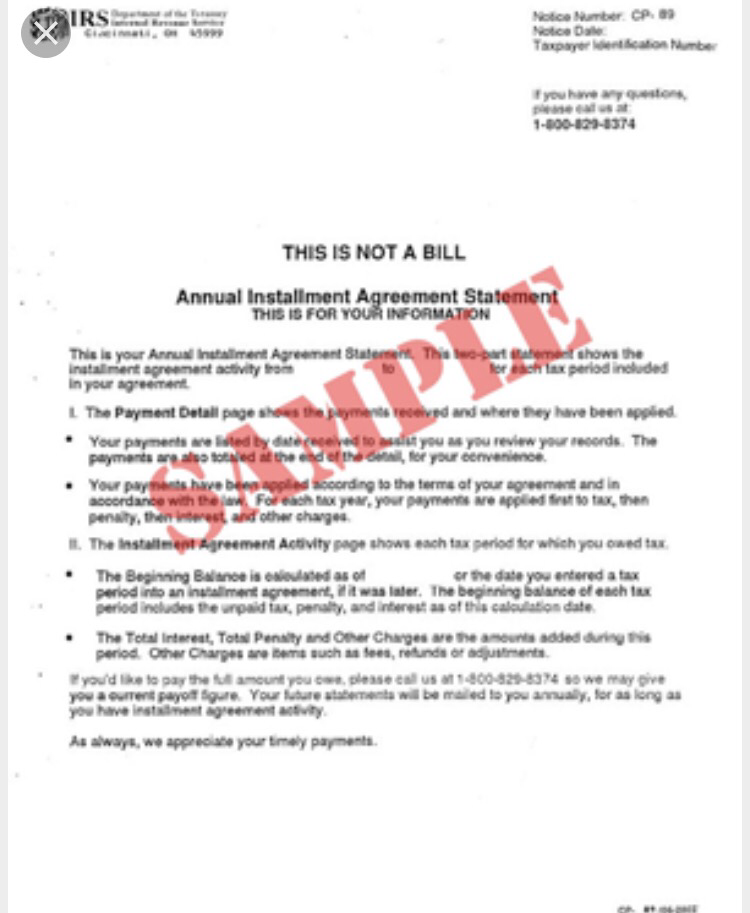

Closed Case: IA6/13/2017 Our team in the past week has solved another tax nightmare for our client in Arlington, Texas. We prepared 2 missing tax returns, we negotiated penalty abatement(s) and a fair installment agreement with the IRS that will satisfy paying off his debt in 72 months. We finalized his case by advising him to start making estimated quarterly payments, this will prevent him from owing more tax debt for the current working year, including future tax years to come. This is key to remain in full compliance, including your tax preparation with the Internal Revenue Service.

Back to Blog

Case closed: IRS NOTICE6/9/2017 Buen trabajo echo! Los Taxes De América®: Hoy recibimos confirmación de las oficinas del IRS, 3 más casos cerrados en CNC status. Donde los Clientes no son obligados ha mandar pagos a la deuda del IRS por mes. Una carta por año, solamente. Para confirmar el status financiero que el Cliente todavía esta en bajo recursos. Después de años, las deudas año por año se cancelan solas. Es hora de vivir sin deudas!!

Back to Blog

cancelo de pasaporte por el irs...5/18/2017 Si tiene una deuda tributaria gravemente incumplida, el IRC § 7345 autoriza al IRS a certificar esa deuda al Departamento de Estado para que actúe. El Departamento de Estado en general no le expedirá un pasaporte después de recibir la certificación del IRS. Al recibir la certificación, el Departamento de Estado negará su solicitud de pasaporte y / o podrá revocar su pasaporte actual. Si su solicitud de pasaporte es denegada o su pasaporte revocado y usted está en el extranjero, el Departamento de Estado puede emitir un pasaporte de validez limitada sólo para el retorno directo a los Estados Unidos.Certificación de las personas con deudas tributarias gravemente morosas , Deudas fiscales federales legalmente exigibles por un total de más de $ 50,000 * (incluyendo intereses y penalidades) por los cuales; lea mas...

|

Nos encantaría tenerte de visita pronto!

|

5525 Oakdale Ave Suite 130

Woodland Hills, Ca 91364 |

|

RSS Feed

RSS Feed